The recent decline in bitcoin transaction costs has made it considerably easier for buyers and others to have access to cryptocurrency. Transaction costs for the popular cryptocurrency have just reduced to ten years levels. To put it another way, maybe now is the best time to switch from paper to digital wallets. The cost of sending Bitcoin all across the network has dropped to decade-low levels, due to the advances in the Lightning Network, batching, miner behavior, and protocol.

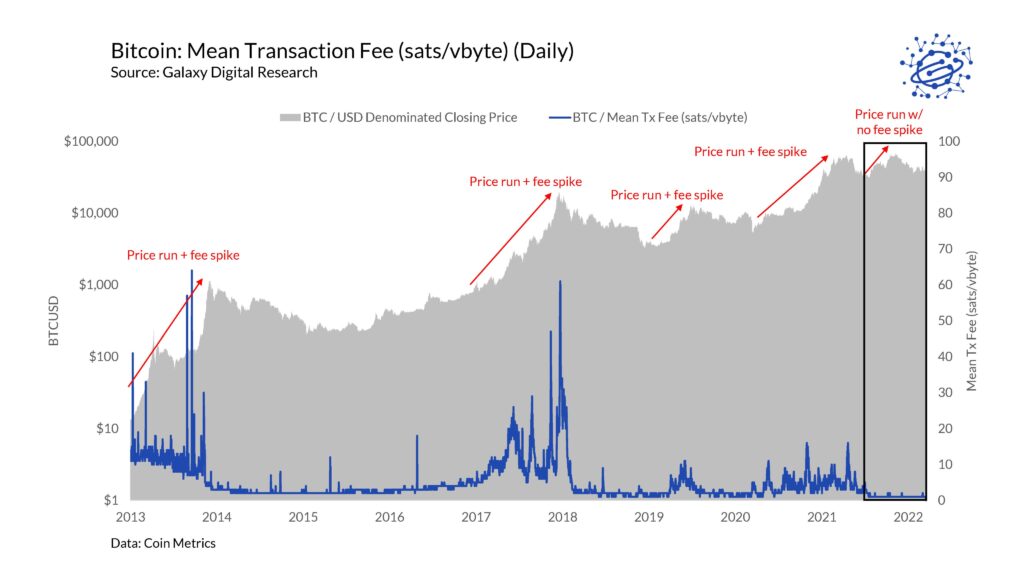

Moving Bitcoin between wallets and exchanges has never been easier. According to Galaxy Digital’s study, Bitcoin transaction costs have reached all-time lows in BTC.

According to the research, the Bitcoin mean transaction fee has dropped to 0.00004541 Bitcoin ($2.06) in 2022, while the percentile has dropped to 0.00001292 Bitcoin ($0.59), the lowest of any year save 2011.

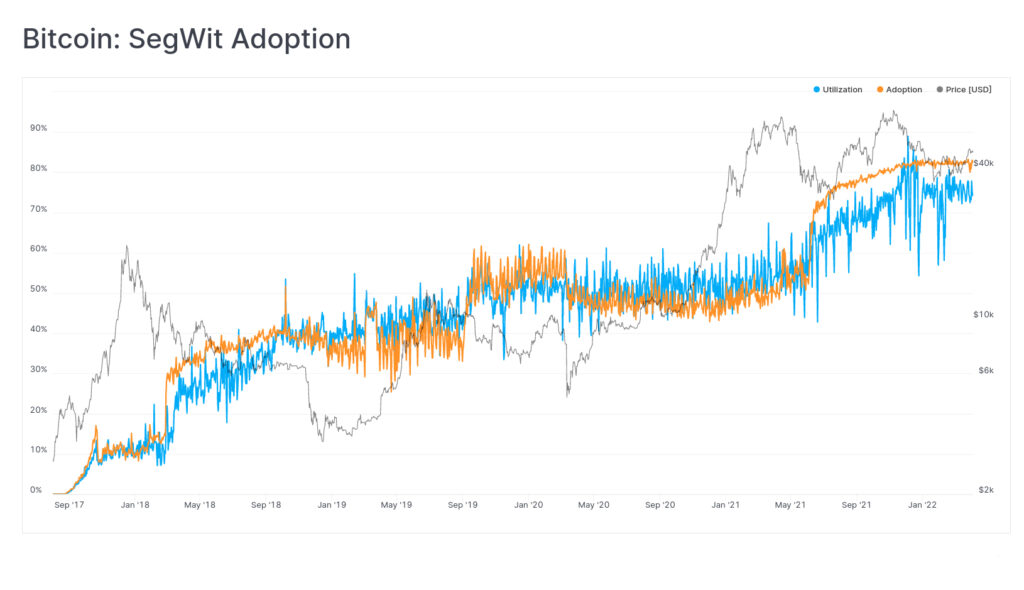

As per Alex Thorn, decline in fees has been caused by a combination of increased Segwit adoption, batching payments, growth in the Internet, a collapse in miners selling, and lower OP Return usage.

James Check, Glassnode’s senior on-chain analyst, concurred with Thorn, telling Cointelegraph that “batching and Segwit are undoubtedly part of that equation,” because the two will expand the number of payments that can enter in a block, increasing throughput and lowering fee pressure.

He submitted the graph below, which shows that Segwit adoption “grew substantially at the lows in May and July.”

“This isn’t the full tale…” says Check, despite the fact that “this isn’t the complete story…”

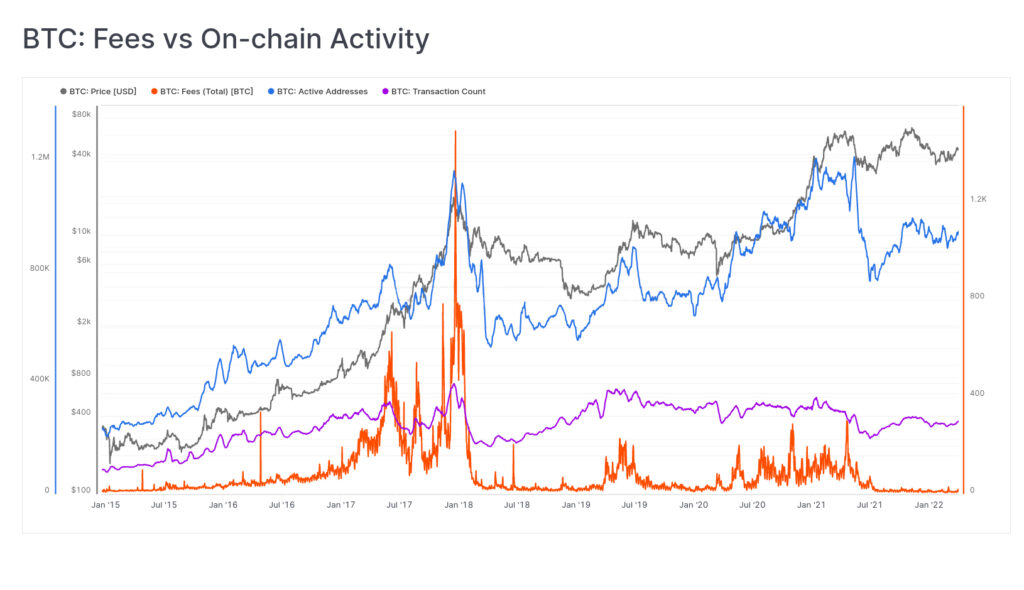

“The main reason I believe fees are low is that in May, we saw a 50% price cut, essentially wiping off retail interest.”

“All three like fees, active addresses, and transaction numbers decreased after the May sell-off,” he argues.

In my opinion, this was the beginning of a bear market, and with the pricing run-up we have seen a large number of people being financially wounded and thus out of the market. We are experiencing systematic changes in the market dynamics, and previous correlations maintain little meaning”, says Eric Yakes to Cointelegraph.

“This, in my view, was the likely commencing of a bear market and even with the price run-up, we saw a great many people financially burned, and thus out of the market.”

The “$70 million secured by Lighting Labs to construct a stablecoin and asset protocol” is a significant milestone for the Bitcoin system’s future. “It’s critical for transaction fees to trend lower,” he added, adding that “transaction charges are the primary barrier to building a network in a decentralized form.”

While service charges are beneficial to wallet administration and the establishment of Lightning channels, they may indicate that market interest has waned. “Look no farther than previous Google trends to see how popular the orange cryptocurrency is right now,” according to Check, who also claims that “there is almost no influx of new users.”

But try your best to keep an eye on bitcoin and other cryptocurrencies in the next months, as they may have a huge impact on their future. Bitcoin has the ability to return to its trading level attained in the spring of 2021 as long as transaction fees remain low and the lightning network continues to expand.

Comments (No)