Although Bitcoin has had a bumpy start to the year, analysts believe it will eventually reach $100,000 and that it will be a matter of great interest. As Bitcoin bulls anticipate a trip to $50,000 recently, the annual open remains in focus as support.

BTC is running at the same level as it was roughly on January 1, 2022, which may feel like a Deja-vu situation for holders.

There are a plethora of indicators to watch in April, despite Bitcoin keeping its yearly open price as support – at least for now.

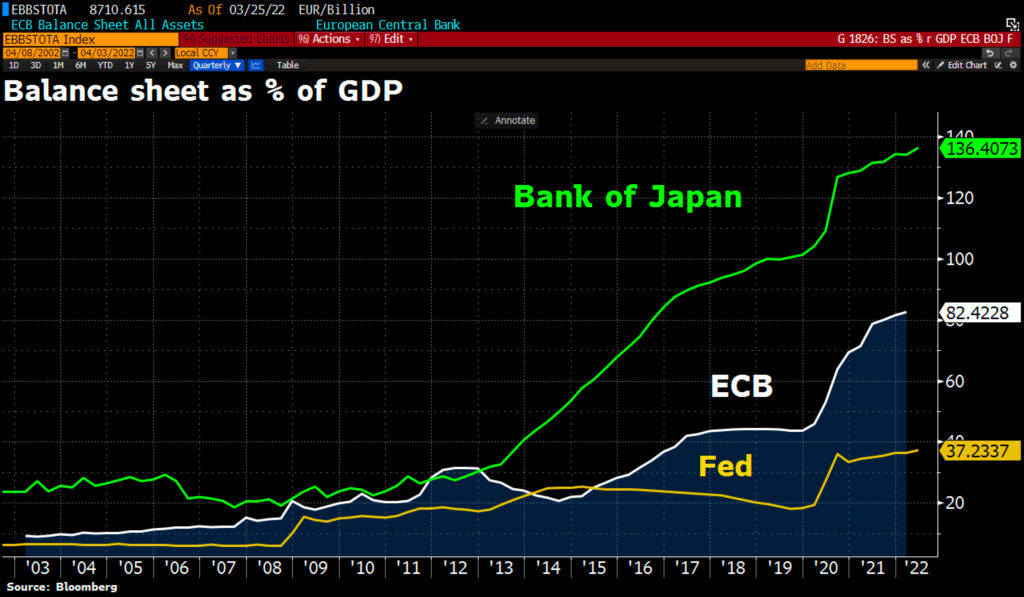

Inflation meets fresh money printing

Commentators have raised serious concerns about what might be a shockwave impacting crypto investment as the US Fed Reserve commits to decrease its record-high balance sheet while continuing to raise key rates.

The Bank of Japan has added to its balance sheet, printing even more liquidity, as noted by market observers. The Bank of Japan already had the greatest balance sheet in terms of GDP, and that trend is continuing, with a current balance sheet of 136 percent of GDP.

Perhaps, it can be the worst monetary experiment so far.

If more printing equals more optimum times for risk assets, not everyone believes the much-hyped balance sheet reductions will endure.

Central banks will soon be forced to resume liquidity injections. Certainly, you get the horns if you tamper with the bull. Remember, it’s not the price of gold or Bitcoin that’s rising; it’s the value of the fiat currency in which they’re priced that’s falling.

Spot bulls focus on $50,000

According to recent data from Cointiko, the traditional but brief euphoria surrounding the weekly close evaporated within hours, with bears still failing to take the yearly open away as support.

BTC/USD is precisely where it was around three months ago, but short-term price signs are already indicating that it will continue upward.

As Cointelegraph previously highlighted, the odds are stacked against Bitcoin reaching $50,000 for the first time this year.

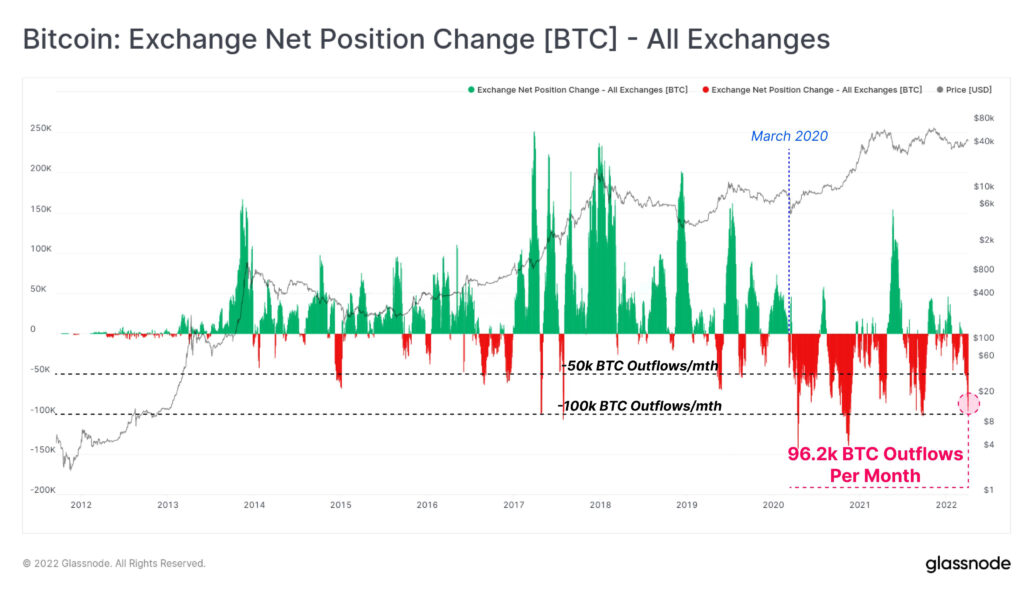

Buyers rushed currencies out of exchanges in March

It’s no news that a lot of Bitcoin has been leaving exchanges this year, but the most recent data reveals the extent of the supply pressure.

According to Glassnode, exchange outflows were unusually high last month, with exchanges losing about 100,000 BTC.

Only two times in Bitcoin’s history have outflows exceeded 100,000 BTC, making March’s one of the largest.

Should investors resume bottom-buying following the COVID-19 disaster, the consequences should be obvious, but it may take some time. While BTC/USD recovered in 2020 following a 60 percent plunge in days, it wasn’t until Q4 that price performance truly changed.

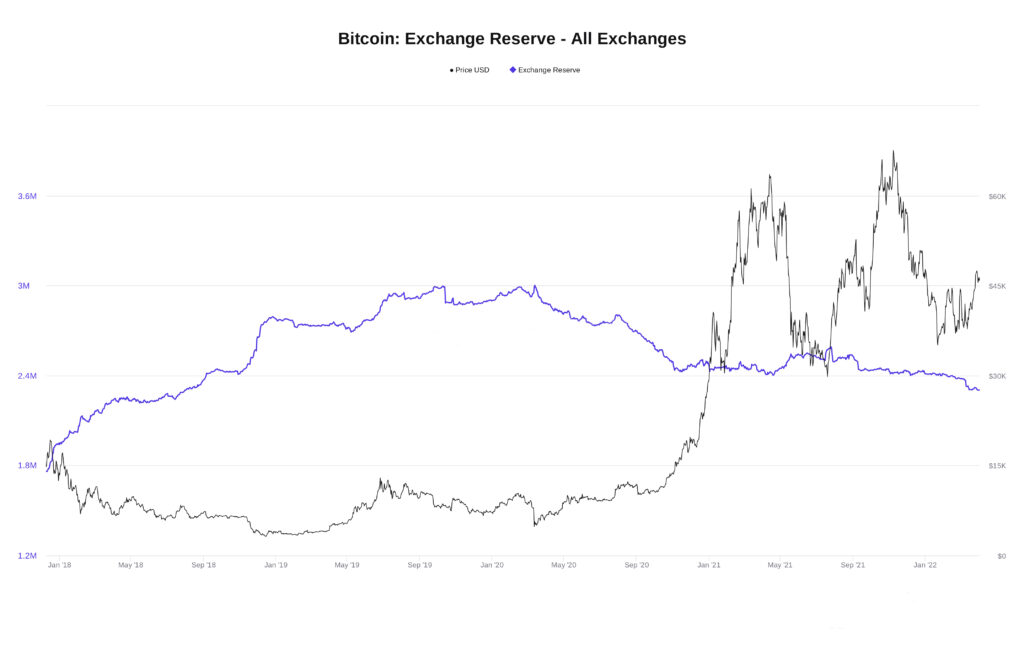

Meanwhile, according to CryptoQuant, which measures the balances of 21 major exchanges, overall BTC stockpiles have dropped to their lowest level since August 1, 2018, with 2.303 million BTC.

Don’t consider the altseason.

When it comes to Bitcoin’s connection with altcoins, something odd has happened. For the first time in over a year, the combined open interest on altcoin derivatives markets has exceeded that of Bitcoin.

Such a viewpoint aligns with data showing significant inflows into cryptocurrencies, which one observer claimed indicated an increase in risk appetite among investors.

Taking the spotlight away from BTC may not be a drag on performance per se, according to Dodan, because volatility is also dropping.

Hash rate reaches a new all-time high.

According to MiningPoolStats, the hash rate is at 223 EH/s, indicating miners’ confidence in the network’s long-term profitability.

Any attack on Bitcoin will inevitably make it stronger, implying a higher price, a greater hashrate, and a higher energy usage.

The debate between Bitcoin and energy is still raging, with a number of well-known experts attempting to explain what they regard as a logical error. Regardless of the narrative, the hash rate continues to rise, confirming the fundamental positive assumption for Bitcoin investment.

Comments (No)