On Wednesday, the coin’s value plummeted from roughly $6.75 to only over $1, before plummeting even more on Thursday. On Wednesday, the terra luna price plummeted from roughly $6.75 to slightly over $1. It dropped even more on Thursday, and as of Thursday afternoon, it was just worth $0.02.

What caused Luna’s Crash?

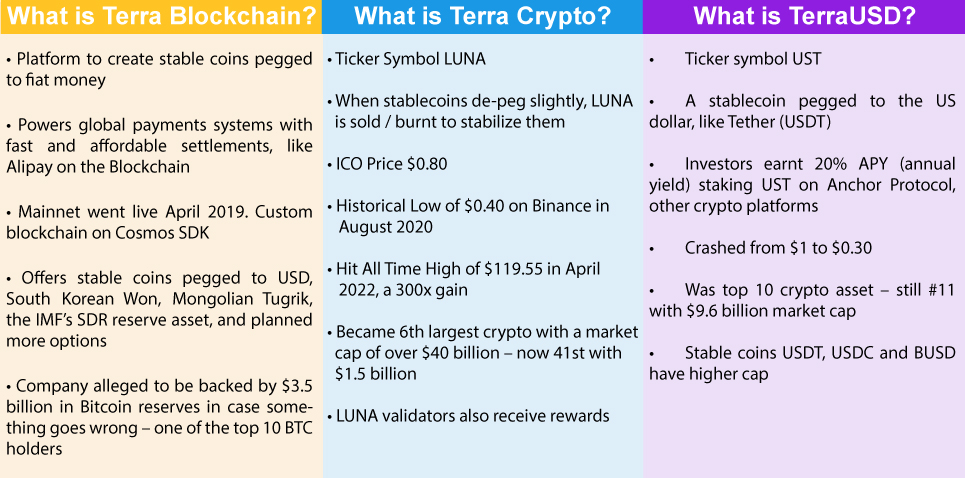

The relationship between Luna and TerraUSD, a coin tethered to the US dollar, basically led to Luna crashing. Stablecoins are cryptocurrencies that are connected to fiat currencies. The UST dissociated from the dollar late this week, sending its price to new lows. Luna’s market capitalization has dropped from £32.9 billion to just over £164 million. On Wednesday, the leading cryptocurrency exchange Binance momentarily halted withdrawals from Luna. The coin’s downfall coincides with a general cryptocurrency decline, with many coins shedding a third of their valuation in the last 24 hours. In the light of widespread inflation, buyers appear to be migrating away from bitcoin and into less hazardous options.

Terra Luna Crash Explained

Investors can destroy 1 TerraUSD coin to produce $1 worth of Luna if the cost of TerraUSD drops to $0.98. The dealer makes a $0.02 return once more, and the exchange mechanism resets the peg, raising TerraUSD’s price by limiting its supply. Terra was the 2nd largest decentralized finance (DeFi) ecosystem before the crisis, and the growing number of DeFi apps on the blockchain drove demand for TerraUSD. The Anchor protocol, for example, was especially popular with investors since it provided 20% APY on TerraUSD investments. This is far superior to what you’d get as a typical savings account.

Terra Luna News

The revelation has prompted speculation over whether the market is entering a predicted cooling spell – nicknamed “crypto winter” previously – or a more persistent chill, possibly a crypto ice age. The question

today for cryptocurrency investors is when the drop will halt,said crypto market strategist at trading platform eToro.

The market is caught up in the greater adversity of financial markets, which are trying to determine where comfortable levels are already in the aftermath of interest rate increases intended to cool skyrocketing inflation across the Western world. Although the currency has the ability to recover, the situation is currently exceedingly unpredictable. Close to unveiling an action plan for $UST, founder of Terraform Lab, posted on Tuesday. “I recognise the very last 72 hours have been tremendously difficult for all of you – but that I am determined to work with each of you to withstand this emergency, and we will construct our way out of this,” he said on Wednesday. With hundreds of dedicated teams producing category-defining applications within the Terra ecosystem, it is one of the most dynamic in the crypto industry.” Terra’s transformation will be breathtaking.

Luna Crash Reason

In some circles, the 30-year-old Do Kwon had a reputation for arrogance on Twitter, so some believe it was a mali scious slight as well. Charles Hoskinson, the founder of Cardano, proposed one possibility, although he later removed the tweet.

He claimed that a huge institution had acquired 100,000 Bitcoin from the Gemini exchange on Twitter. They subsequently exchanged a big amount of BTC for UST at a discount with Do Kwon over the counter (OTC). He agreed, and the UST liquidity was reduced. That institution allegedly dumped massive sums of BTC and UST on the market, resulting in a liquidation avalanche of leveraged longs, slippage, & panic selling by investors, with many liquidating their LUNA investments and unstaking their positions. So the luna crash reason, it’s difficult to sort out.

Is it Wise to Invest in Terra Luna now?

Investors lost faith in Terra afterde-peg of its linked algorithmic stablecoin UST. Basically the circulating supply of LUNA, which has been used to peg UST at $1 value, shed value as investors dumped the asset swiftly, while its floating supply was raised from 350 million to 2.5 billion in three days to enable UST recover its peg. LUNA’s market capitalization has dropped to billions, or less $300 million to be exact. The LUNA token’s volume has been fairly amazing, with

tokens valued $7.75 billion changing exchanges over the last 24 hours, according to coinmarketcap data.

Market experts are hopeful about the prospects of LUNA and believe the coin will recover. However, they feel that repegging UST will take time and that the agony will endure longer.

Luna Crash Explained

Luna’s market capitalization has dropped from £32.9 billion to just over £164 million. On Wednesday, the leading cryptocurrency exchange Binance momentarily halted withdrawals from Luna. The coin’s demise coincides with a general cryptocurrency decline, with many coins shedding 25% of their valuation in the last 24 hours. In the light of widespread inflation, traders appear to be migrating away from bitcoin and into less hazardous options.

Coinbase’s stock plunged 15.6 percent overnight on Wednesday after the company reported financial losses of £348 million significantly more than experts expected. Coinbase mentioned a pattern of both decreasing crypto asset values and volatility that started in late 2021, but was careful to clarify that this does not mean the market is in decline. The revelation has prompted speculation over whether the market is entering a predicted cooling spell – nicknamed “crypto winter” previously – or a more persistent chill, possibly a “crypto ice age.”

Why did all crypto drop today?

As per CoinMarketCap data on Monday, the worldwide crypto market cap has decreased to $1.54 trillion, down 2.28 percent in the last 24 hours. Almost all of the top ten cryptocurrency values have dropped in the last 24 hours, while the worldwide cryptocurrency market volume has climbed by 3.18 percent to $96.96 billion. The total volume in DeFi was $11.39 billion, or 11.39 percent of the total 24-hour volume in the crypto market. The 24-hour volume of stable coins was $87.56 billion, accounting for 90.3 percent of the total cryptocurrency market volume. The price of Bitcoin has also dropped to $33,628.

Bitcoin’s position as the most valuable crypto asset has remained stable over the last day, at roughly 41.48 percent. In the last seven days, the price of Bitcoin has dropped 13.64 percent. Bitcoin’s price has dropped 2.25 percent in the last 24hrs.

In the previous 24 hours, the price of Ethereum has dropped 3.41 percent to $2450. The price of ETH has dropped 14.15 percent in the last seven days. It is presently the second most valuable crypto asset by market capitalization.

Binance (BNB): In the last 24 hours, the price of Binance currency has dropped 3.13 percent to $347. The price of BNB has dropped 11.05 percent in the last seven days. In terms of market value, it is now the fourth largest crypto asset.

XRP: In the previous 24 hours, the price of the XRP coin has dropped by 0.55 percent to $0.5656. The price of XRP has dropped 9.40 percent in the last seven days. It is presently the 6th most valuable crypto asset by market capitalization.

During the last 24 hours, the price of Solana (SOL) has dropped 13.41 percent to $74.91. The price of SOL has dropped 16.73 percent in the last week. In terms of market capitalization, it is now the seventh largest cryptocurrency.

Cardano: For the last 24 hours, the price of the Cardano cryptocurrency has dropped by 4.21 percent to $0.7069. The price of ADA has dropped 10.53 percent in the last week. In terms of market value, it is now the eighth largest cryptocurrency.

Frequently Asked Questions

At the head of the TerraLuna Reddit page is a long array of suicide prevention hotlines, including Australia’s LifeLine and comparable agencies from the United States, the United Kingdom, France, China, Sweden, & 90 other countries. Many Reddit enthusiasts have also shared their horror stories about losing money on Terra & Luna cryptocurrency acquisitions.

The company’s market valuation dropped from about £32.9 billion to approximately £411 million as a result of the unexpected implosion, resulting in devastating losses. So the chances seem to be difficult and probability still exists.

The catastrophic collapse of Terra (Luna), which was formerly one of the top ten most valued cryptocurrencies, has wrecked effects on the minds of investors who dread becoming homeless as a result of the crypto chaos. So we can’t call it a good investment but the future might transform.

Comments (No)